30+ how does a home mortgage work

Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Many people refinance to a shorter term to save on interest.

30 Mortgage Wordpress Themes Templates

The most common term is 30 years but there are also mortgages that are 20 15 or 10 years.

. Ad AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees. Mortgages are loans which you take out so you can purchase a home. For example say you started with a 30-year loan but can now afford a higher.

Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. The average 30-year fixed mortgage interest rate is 708 which is an increase of 7 basis points from one week ago. Web What are mortgages.

Web With either lender that means that your monthly payment is 66530. In the case of a fixed-rate. Web 2 days agoHow does a mortgage rate lock work.

Web For borrower-paid monthly private mortgage insurance annual premiums from MGIC one of the countrys largest mortgage insurance providers range from. Compare Lenders And Find Out Which One Suits You Best. If the point is 1 percent of 100000 1000 the application fee is 25.

The interest rate is determined when you first take out the loan and it stays the same over the entire. Web You borrow the money from a mortgage lender to cover the cost of the home purchase now and then pay off the loan with interest over a set period of years. Web Most new homeowners will get a mortgage with an amortization period of 25 years but in some situations you can get a 30-year amortization period.

Mortgages work by charging you interest on the amount you want to. Ad AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees. Instead your lender may port the 234 rate on 200000 give you 219 on the 100000 increase then blend the two rates as a weighted.

Home buyers will typically have to decide between a fixed-rate mortgage and an adjustable-rate mortgage. Get A Free Information Kit. Web A loan term refers to the length of the mortgage payment schedule.

Ad 5 Best House Loan Lenders Compared Reviewed. A basis point is. Free Guide For Homeowners Age 61.

Web It is a mortgage loan with a 30-year repayment term and a fixed rate of interest. Web In simple terms a mortgage is a type of loan designed to help you buy a house. With a 2-1 buydown you would pay an upfront fee of 6000 to.

Ad Reviewed Ranked. Comparisons Trusted by 55000000. To find the APR you determine the.

Looking For a House Loan. It doesnt apply to investment property. Web The answer is no.

Change Your Loan Term. Compare Lenders And Find Out Which One Suits You Best. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today.

Looking For a House Loan. Turn A Portion Of Your Homes Equity Into Supplemental Cash With A Reverse Mortgage Loan. Furthermore the loan value and.

Web How Mortgages Work. Web Lets say you take out a 300000 30-year fixed-rate mortgage with an interest rate of 45. When you apply for a mortgage you need to put down a percentage of the cost of the property.

If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Web According to our mortgage calculator which you can use to model your own scenario monthly principal and interest payments at 465 would be 1025 on a. Web When you first take out a mortgage the bulk of your monthly payments will usually go toward interest or the amount you owe your lender for financing the loan.

Ad An Easier To Qualify Reverse Mortgage Alternative. Each month part of your monthly payment will go toward paying off that principal or mortgage. Comparisons Trusted by 55000000.

Shared Equity Is A Reverse Mortgage Alternative with Better Lenders Requirements. Ad 5 Best House Loan Lenders Compared Reviewed. Web So in terms of the mortgage deduction it only applies to your primary residence or a second home.

Imagine youre a homebuyer who is taking out a 300000 mortgage and that the current rate on a 30-year fixed rate. Turn A Portion Of Your Homes Equity Into Supplemental Cash With A Reverse Mortgage Loan. Web The money used to lower the buyers monthly payments is deposited into an account and taken out each month by the mortgage loan lender.

Web 1 day ago30-year fixed-rate mortgages. Keep in mind with a. Web The amount you borrow with your mortgage is known as the principal.

Web Fixed-Rate Mortgages. Web Heres an example of how extra costs can increase your payment assuming a 30-year fixed-rate mortgage of 360000 at 652. When you purchase a home a mortgage loan allows you to finance the price of the sale minus any cash you bring to the table in the form of a down.

Should You Pay Off A Mortgage Early Part Ii Charts And Graphs

Learn Everything You Need To Know About Mortgages

How Does A Mortgage Work When Buying A House Laura Alamery

Investor Loan Virginia Delgado Mortgage Loan Officer

Realtors Lets Collab Fixed Young Kwon Mortgage Loan Officer

The Ultimate Mortgage Guidebook Homewise

Which Mortgage Is Better 15 Vs 30 Year Home Loan Comparison Calculator

Loan Officers Homebot

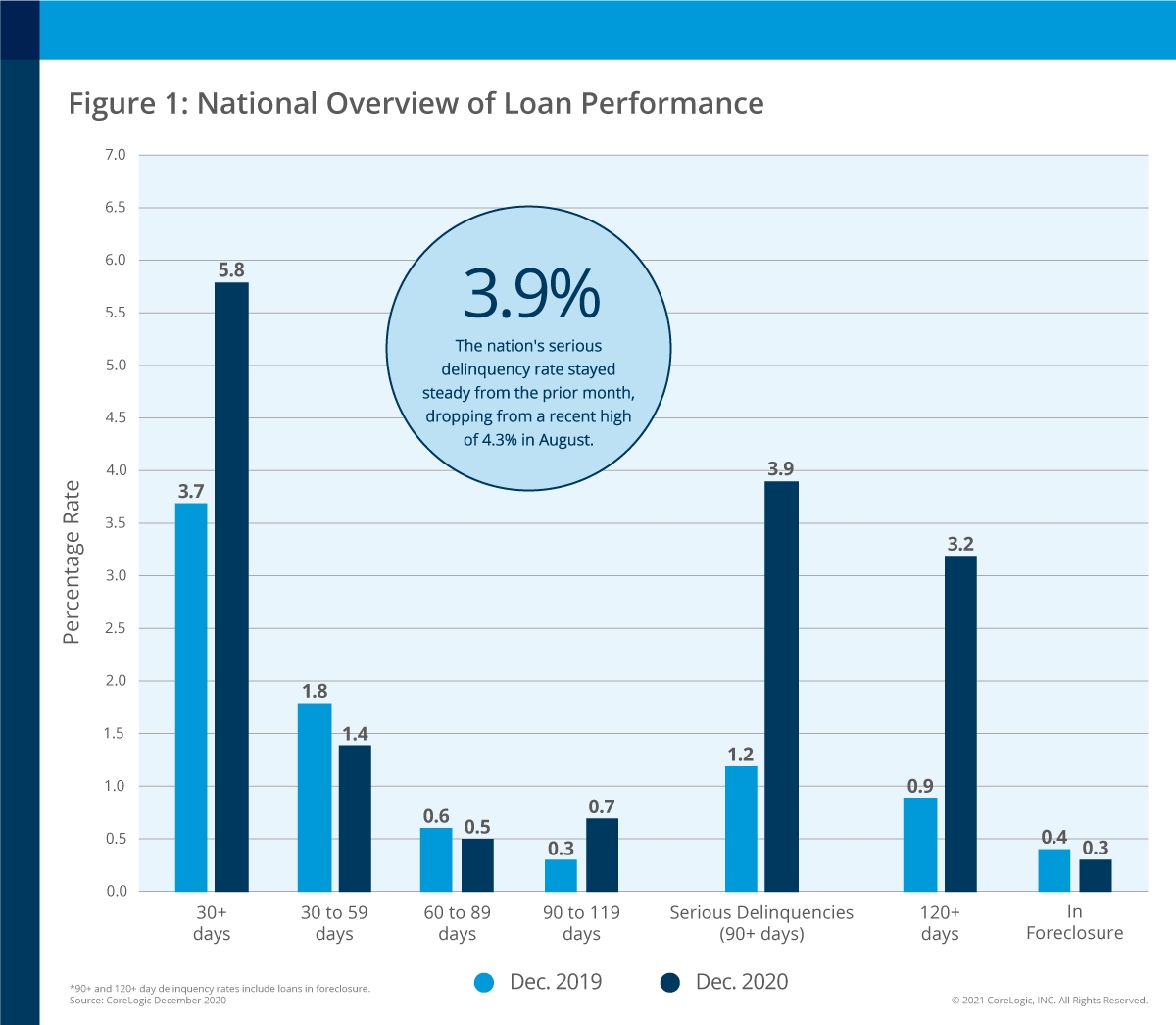

Mortgage Delinquencies Rose For The First Time In 9 Months What Does That Mean Marketwatch

Buying A Home With Bad Credit In Grand Rapids Mi Michigan Bad Credit Mortgage Loans

A Look Back Us Mortgage Delinquency Rates Experience Record Highs And Lows In 2020 Corelogic Reports Business Wire

Top 10 Mortgage Mistakes To Avoid For A Smooth Home Loan Experience

Mr Cooper Reviews 361 Reviews Of Mrcooper Com Sitejabber

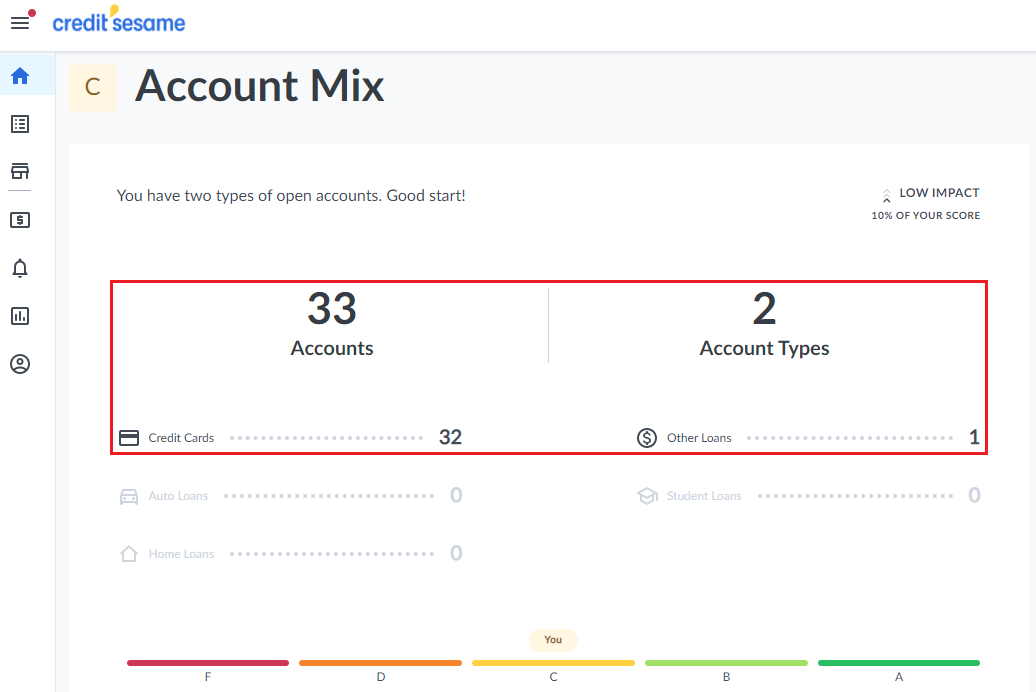

My 12 Month Experiment To Open An Installment Loan To Increase My Credit Score

Should You Pay Off A Mortgage Early Part Ii Charts And Graphs

Plaza Home Mortgage Mortgage Rates 6 68 Review Closing Costs Details Origination Data

Wfc2022